Comparison Websites

If you type “price comparison website” into any search engine and you will be presented with scores of sites promising to save you money on everything from your broadband and phone to travel insurance. While many of the sites are automated and just trawl other websites to collate pricing information in real time for people too busy to do the research themselves, there are also a growing number of personalised services which use real interaction to find people better value for money.

The first area where money can be saved is utility bills. A couple of years back, hundreds of thousands of Irish people cleverly made the Big Switch and moved from ESB to Bord Gáis Energy (both previously Irish state owned), which was promising to undercut the one-time monopoly by as much as 20 per cent. People made the change and then thought the job was done and they would be able to avail of the savings for ever, but after the year-one discounts were gone, the providers quickly switch consumers back to the higher rate – so what people need to do is shop around all the time.

Activities – Comparison Websites

Compare broadband offers in your local area

Compare broadband offers in your local area by using accredited websites below, and decide on which option offers lowest price and unlimited download capacity.

Compare Mortgages to Find a Lower Interest Rate

Compare mortgages at the CCPC website below and decide if you are a first time buyer or if you are a likely mortgage switcher.

www.ccpc.ie/consumers/financial-comparisons/mortgage-comparisons/

Government Services - Ireland

MyGovID

www.mygovid.ie gives Irish citizens a secure “single sign on” to their public services. It is built on the Public Services Card, linking a ‘real word’ identity to an online identity. It can already be used to access Revenue’s ‘myAccount’ services and ‘MyWelfare.ie’ online services from the Department of Social Protection.

MyGovId provides users with a safe secure online identity for Irish government services. A MyGovId account will act as a secure “single sign on” identity for multiple online government services across a variety of government and public sector organisations.

Users can already access a range of social welfare services and Revenue’s “MyAccount” service using a MyGovID account. Eventually, all government online services will migrate to the secure MyGovID platform.

See more in press release from 23rd March 2017:

Besides the www.mygovid.ie website mentioned above, here is a list of the main Irish government websites:

Irish Government Information Portal

myAccount enables you to access PAYE services (including Jobs and Pensions), Local Property Tax, Home Renovation Incentive and many more services using a single login and password. You can also update your personal details, review your tax affairs, make payments and apply for certain tax reliefs and incentives.

www.ros.ie/myaccount-web/home.html

MyWelfare website can be used for a variety of services including application services, jobseeker's services, request payment statements and booking appointments for allocation of Personal Public Service Numbers and Public Services Cards.

MABS is the Irish State’s money advice service, guiding people through dealing with problem debt for more than twenty years.

And finally, here is a website that needs no introduction…

Activities – Government Services

Calculate Income Tax Payable

Calculate your income tax payable by referring to revenue website to find out tax credits and standard rate cut-off point, and then checking it corresponds with amount deducted each week/month from your wages/salary.

See the following websites for guidance…

www.citizensinformation.ie/en/reference/case_studies/case_study_calculating_your_income_tax_case_studies.html

www.revenue.ie/en/tax/index.html

Many people have experienced financial difficulty due to recession, reduction in working hours or job loss, or need for expensive medical procedure. You may have high outgoings like college fees and books, car maintenance or upgrade, or high rent/mortgage fees.

Many people have experienced financial difficulty due to recession, reduction in working hours or job loss, or need for expensive medical procedure. You may have high outgoings like college fees and books, car maintenance or upgrade, or high rent/mortgage fees.

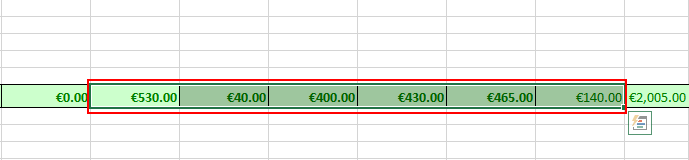

Figure: Pasting of link for Monthly Budget Balance into Cash Flow Analysis worksheet

Figure: Pasting of link for Monthly Budget Balance into Cash Flow Analysis worksheet

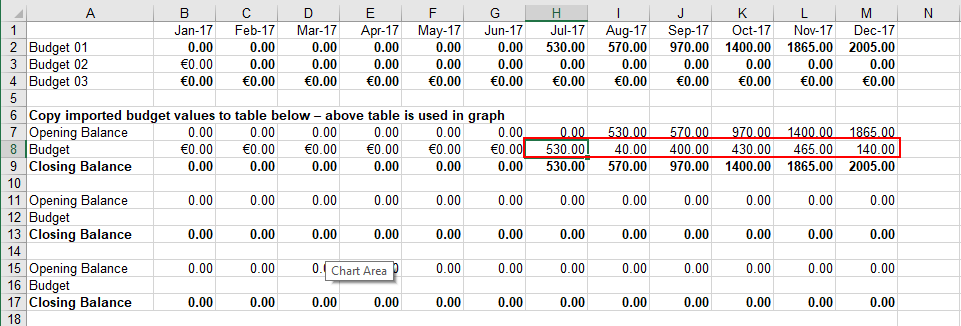

Figure: Cash Flow Analysis Chart

Figure: Cash Flow Analysis Chart