Many people have experienced financial difficulty due to recession, reduction in working hours or job loss, or need for expensive medical procedure. You may have high outgoings like college fees and books, car maintenance or upgrade, or high rent/mortgage fees.

Many people have experienced financial difficulty due to recession, reduction in working hours or job loss, or need for expensive medical procedure. You may have high outgoings like college fees and books, car maintenance or upgrade, or high rent/mortgage fees.

There are also other factors that can contribute to financial difficulty such as a relationship breakdown, increased expenditure or poor budgeting with simply not enough money to go around.

Step 1 – Complete a Financial Health Check

A financial health check will give you a clear picture of your finances and helps you identify where you need to make changes. You should complete this step at least once a year, particularly if your income changes or you experience a big life event. See Consumerhelp website link below for steps to carry out financial health check.

Step 2a – Identify Your Goals

Whether it is saving for a holiday next year, paying off your credit card debt or starting an emergency fund, everybody has different goals. When you have a goal, you will find it easier to stick to a budget. Once you identify your goal, you need to work out how much it will cost and how you will put money aside to achieve it.

Step 2b – Prioritise Goals

Once you have a list of Goals, you should then list them in order of priority so that you can attend to most important ones first. For instance, would you rather pay off your mortgage ten years early or take a holiday. Is being able to retire early more important than putting your children through college.

Step 3 – Make a Budget

A budget is simply a plan showing how much you expect to receive and how you plan to spend it. It will show you how much money is coming into your household, your main outgoings and how much you can afford to offer to those you owe money to - your Creditors like Credit Card Bills, Loans Outstanding etc. For Goals set in 2a above, you may need to set realistic targets and work towards them in easy stages. You should allocate a certain amount each month towards your Goal so that you can gradually save the required amount in time for the event e.g Education Fees need to be available in time for your eldest child starting College.

See more at :-

https://www.ccpc.ie/consumers/money/budgeting/managing-your-money/

Activities – Managing Your Money

Produce Excel Cash Flow chart using Budget spreadsheet as Input

Introduction

This tutorial takes you through all the steps to produce an Excel Cash Flow Chart for a typical 6 month budget period. The Excel Cash Flow Chart will give you an idea how well your budget will balance over a given budget period – it shows at a glance if your balance will be likely to grow, breakeven or go into a deficit.

Step 1 – Open Sample Budget Cashflow Spreadsheet

There is a sample Budget Cashflow Spreadsheet available in the following shared folder for you to use, it is called - GNUCashflowanalysis - PC Tutor - Qtr 3 2017.xlsx

PC Tutor Activity Files - Live

Step 2 - Set-up personal budget for 3-6 month period

The first step in creating a budget is to decide what it is you want to track and analyse. This decision will affect which sections you include in the sample Budget Cashflow Spreadsheet. For example, if you want to track all your cash flow, you may create a cash flow budget by entering amounts for asset, liability, income and expense categories.

Before creating a budget, you must also decide what period of time you want to plan for. The most common budget periods are monthly and annual. If you want your budget to plan for changes in financial patterns over time, then you should include multiple budget periods in your budget. For example, if you want to plan on having higher utility expenses in the winter than in the summer, then you might break your annual budget into 4 quarters or even 12 months, and budget a higher value for the winter periods than for the summer periods.

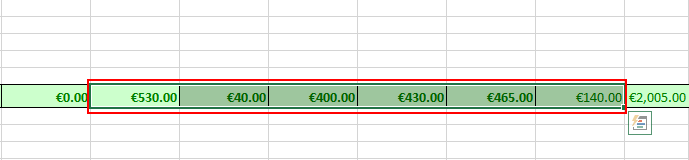

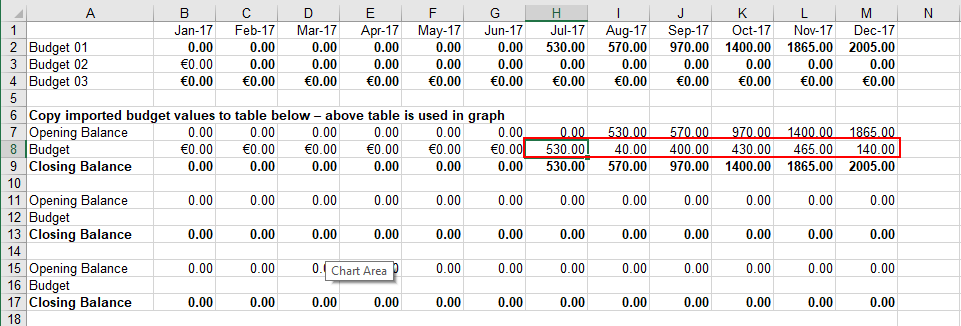

Figure: Sample Budget Cashflow Spreadsheet showing 6 month budget from July 2017

Figure: Sample Budget Cashflow Spreadsheet showing 6 month budget from July 2017

Step 3 – Copy balance from Budget Worksheet and Paste into Cash Flow Analysis Worksheet

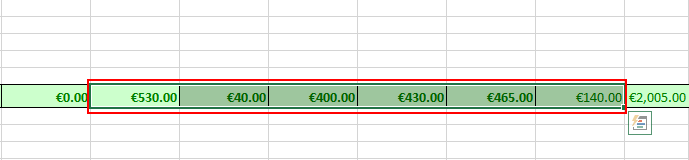

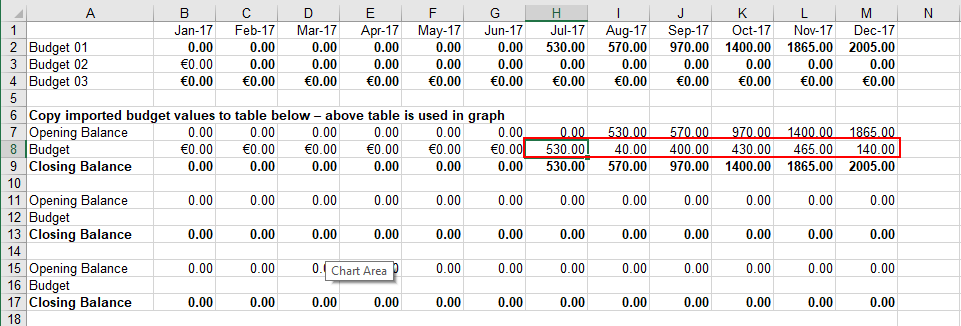

Figure: Copy Monthly Budget Balance from July 2017 to Dec 2017 from Budget Worksheet

Figure: Pasting of link for Monthly Budget Balance into Cash Flow Analysis worksheet

Figure: Pasting of link for Monthly Budget Balance into Cash Flow Analysis worksheet

Step 4 - Interpret results.

Figure: Cash Flow Analysis Calculations

On the screen above, you can see the Cashflow calculations in the Closing Balance row. It is basically a cumulative sum of each Monthly Budget Balance within budget period.

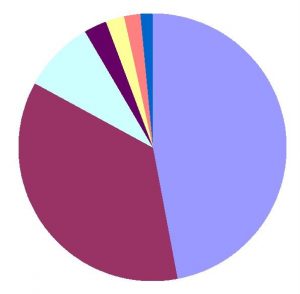

Figure: Cash Flow Analysis Chart

Figure: Cash Flow Analysis Chart

Finally, the above Cash Flow Analysis chart shows how the budget balance grows during the budget period.

Many people have experienced financial difficulty due to recession, reduction in working hours or job loss, or need for expensive medical procedure. You may have high outgoings like college fees and books, car maintenance or upgrade, or high rent/mortgage fees.

Many people have experienced financial difficulty due to recession, reduction in working hours or job loss, or need for expensive medical procedure. You may have high outgoings like college fees and books, car maintenance or upgrade, or high rent/mortgage fees.

Figure: Pasting of link for Monthly Budget Balance into Cash Flow Analysis worksheet

Figure: Pasting of link for Monthly Budget Balance into Cash Flow Analysis worksheet

Figure: Cash Flow Analysis Chart

Figure: Cash Flow Analysis Chart